One of the most common misconceptions that I hear in the bitcoin space is that “If you don’t spend your bitcoins, then it will never reach mainstream adoption”. While it’s good to use your bitcoins as a medium of exchange, the only way that mainstream adoption will ever be possible is if someone else first wants your bitcoin as a store of value. So, who is most likely to use bitcoin? The answer is simple. Bitcoin is for savers and fiat is for debtors. Which one do you want to be?

Bitcoin Is For Savers

Ok, so you finally got some bitcoin. Now what? What should you do with it? You should save it for later because bitcoin is for savers.

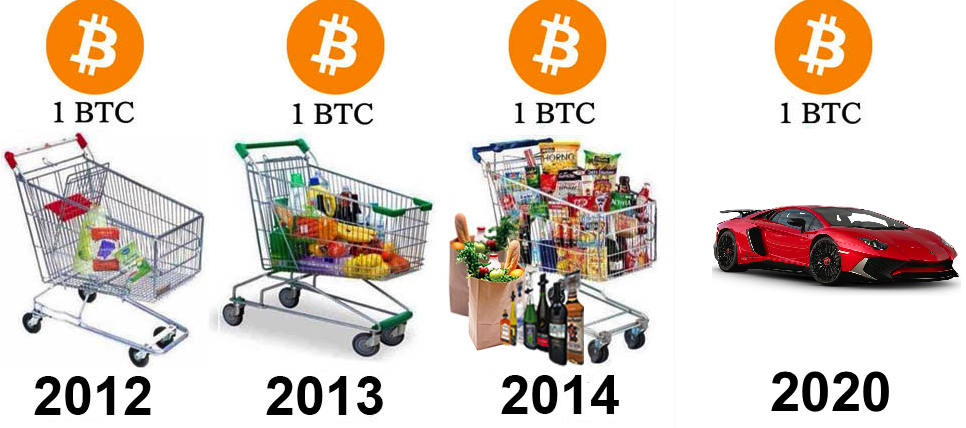

In economics, deflation is a decrease in the general price of goods and services due to the rising value of a currency or monetary unit. This means that over time, deflation enables people to purchase more goods and services with the same amount of money. So, as the price of bitcoin continues to climb, the cost of goods and services will continue to fall. Imagine how much easier it would be to save for a car or a down payment on a house when your purchasing power increases over time.

This bitcoin meme has been circulating since bitcoin’s inception and it will continue to evolve as more people save their bitcoins.

Most modern economists generally believe that deflation is bad for economic activity because as the value of your currency continues to rise, it typically reduces spending and increases the real value of debt. This wouldn’t be such a problem if the majority of modern societies weren’t based entirely on debt and consumption but that isn’t the case. Can you imagine how much debt you wouldn’t have if your purchasing power increased over time?

You might also hear economists claim that bitcoin will never work because most people “hoard” their bitcoins. What they don’t acknowledge is that the word “hoard” is just their biased way of saying “store value” or “savings” and contrary to what you may have heard, savings is actually a very good thing for a healthy economy. People will save their bitcoins until their needs and wants outweigh their desire to hold their bitcoins. Eventually, two or more parties who recognize bitcoin as a store of value will naturally find a way to use bitcoin as a medium of exchange and it will only grow from there. Within the next decade, Bitcoin will prove to be one of the healthiest economies in the world and it’s primarily thanks to their deflationary economic model.

In short, a deflationary money system incentivizes savings, discourages debt, discourages waste and over time, creates more purchasing power for the society that uses it. That’s because bitcoin is for savers. Now let’s take a look at how inflation does pretty much the exact opposite.

Fiat is for Debtors

In economics, inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. Currently, the inflation rate of the US Dollar is about 3-5% annually which means that a $100 (1,236,936 sats) item at the store today will likely cost you $103 (1,274,044 sats)-$105 (1,298,783 sats) in exactly one year. What this also means is that if you do not get at least a 3%-5% pay raise each and every year, you are working just as hard for less purchasing power. The end result is either a lower standard of living for the same amount of labor or the same standard of living for an increased amount of labor. You either end up with less time or less money to do the things you want.

The majority of fiat money supplies are inflationary and based on money being printed out of thin air from a central bank and then lent to other large banks at interest. The money is then lent out to smaller banks (again, at interest) and then eventually the money is finally lent to people like you and me (yet again, at interest) in form of home loans, business loans, auto loans, student loans, credit cards, secured loans, unsecured loans, lines of credit and a number of other debt-based financial instruments.

After all of that interest-bearing debt has worked its way down to people like you and me, we end up paying up to 20% interest just to get small loans for things like buying a car or investing in education. The entire system is based on putting people into debt to the banking system and that is only if your credit score is good enough to be worthy of debt. Fiat is for debtors.

But wait, the debt ripple effect doesn’t stop there. It keeps going by directly affecting the purchasing power of the currency that is being inflated.

Back in 2007, the country of Zimbabwe was the victim of their government hyper-inflating the money supply. Month-to-month inflation rates had exceeded 50% which ends up to compound to about 12,000% annually. This means that for the people of Zimbabwe, something that cost $100 (1,236,936 sats) on the first of the year would cost $12,000 (148,432,369 sats) exactly one year later. Yes, you read that correctly. You don’t need to be an economist to see that it doesn’t make any sense to save when money loses its purchasing power that quickly.

In short, inflation incentivizes debt, incentivizes consumption, discourages savings and reduces the purchasing power of everyone within an economy. It is no wonder why countries that struggle with high inflation rates, tend to find themselves in economic turmoil.

Take Action. Use Bitcoin.

Bitcoin is going to continue to reach new all-time highs and with each and every article that gets published, people start asking what bitcoin is and how they can get some and use it as savings.

The primary use case of bitcoin today is as a store of value like a savings or investment but in the not so distant future, we will see bitcoin emerge as the dominant medium of exchange in a growing number of communities around the world.