The advent of Bitcoin has revolutionized the way we think about money and its creation. For centuries, the power to create money has been held by central banks and governments, giving them significant control over the economy and financial systems. However, with the emergence of Bitcoin, this paradigm has shifted, and for the first time in modern history, the power to create money is in the hands of the people.

Who Has The Power To Create Money?

Historically, the power to create money has always been in the hands of those who rule. Whether it be governments with the power to mint coins made out of various rare earth metals or paper money monopolies that began in China and made their way west, the ruling class has always used its power to exert influence and control over the people who used their various forms of money. Even the invention of double entry accounting enabled the creation of banks with immense power because they had the power to add or remove balances with the stroke of a pen.

It wasn’t until the invention of bitcoin that we discovered the power to create money in the digital age is possible without the need for any centralized powers or institutions.

Money Made By Rulers

Money made by centralized rulers is as old as money itself. You don’t have to do much digging to find this all throughout history.

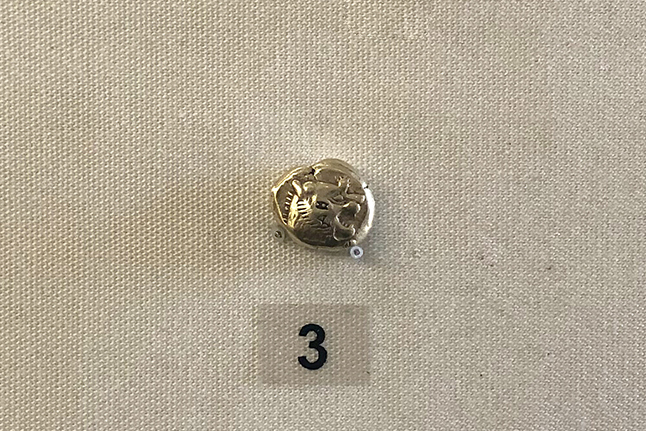

Some of the first coins ever minted by a ruling class are from 400 BC in Lydia (modern day Turkey) with the head of a Lion but it didn’t take long for the ruling class to use money to project power by minting coins with their own image on them. These rulers were often wealthy families with the power to mint their own coins of gold and silver and were responsible for guaranteeing their use sometimes through economic control and other times by brute physical force.

This is a practice that we have seen for centuries and is still practiced today with faces of royals, dignitaries, and political leaders stamped into metal coins or printed onto paper money.

Rulers have even used religion as a means of establishing dominance of one form of money amongst religious groups. Even today in the United States Of America, you can still find the words “In God We Trust” while other bank notes actually have images of gods and deities.

Rulers even used images of fauna that are often associated with power and prestige such as eagles, lions, elephants, bears, and other large powerful animals. It’s not often you see something undesirable like a cockroach or dung beetle on money.

Flora such as wreath laurels or colorful flowers are used on money not only to showcase beauty but also to help illiterate users to be able to distinguish between different denominations of money.

As is true with all human-based frameworks, they are susceptible to human greed and corruption and the power to create money is no different. As soon as rulers came to the realization that they can inflate the money supply by diluting metal coins with less precious metals or print more paper money out of nothing, it didn’t take long for them to attempt to use their hidden power to gain dominance over their own people and even finance wars against people beyond their domain.

As we have seen time and time again throughout history, technology is disruptive and bitcoin is one of the most disruptive technologies in the world today. It might even prove to be the most disruptive technology in history because it has truly shifted the power to create money away from the ruling class and into the hands of the working class. This has immense implications for anyone who trades their time and energy (labor) for money.

The Shift Of Power

The history if money is not just one that was dominated by the elite class. There are plenty of historical instances when the power to create money was in the hands of the people purely out of necessity. Since money is nothing more than the most salable good within an economy, it’s only natural that certain resources rise to the top of trade within any given trade region. One such instance was in the early days of the American Colonies was the use of wampum. Originally crafted by indigenous people groups, these beads were specially made from shells which made them difficult to produce too quickly. Their very existence was proof of work and could not easily be counterfeit. The unforgeable costliness of wampum made it a tool for trade and barter leading up to the foundation of the United States.

Bitcoin is the creation of our own money controlled by the people but creating money that is purely digital without a centralized issuer or money printer is difficult. Thanks to the genius of Satoshi Nakamoto, the power to create money in a digital age became a reality when the genesis block was mined and changed the course of history forever.

This decentralization of money creation is a game-changer. Bitcoin operates on a peer-to-peer network, allowing individuals to transact with each other without the need for intermediaries like banks, governments, or corporations. Bitcoin’s underlying technology, the blockchain or timechain, ensures that all transactions are linked to each other all the way back to the beginning of Bitcoin. This transparent nature of bitcoin makes it almost impossible to fool the network of bitcoin nodes and miners.

The fact that anyone with an internet connection can participate in the Bitcoin network and contribute to its growth is a testament to its democratic nature. Unlike traditional fiat currencies, which are controlled by central authorities, Bitcoin’s supply is determined by the bitcoin consensus rules that ensure a fixed total supply of 21 million coins.

This limited supply and decentralized governance model make Bitcoin an attractive alternative to traditional currencies. Individuals can now take control of their financial lives, making transactions without relying on intermediaries or trusting third-party institutions. Moreover, Bitcoin’s open-source protocol allows developers from around the world to contribute to its development and improvement. This collaborative approach has led to numerous innovations and improvements in the bitcoin ecosystem.

Use Bitcoin To Challenge The Power To Create Money

The impact of this shift in power to create money cannot be overstated. For decades, people have been at the mercy of governments and financial institutions when it comes to monetary policy. With Bitcoin, individuals have a say in how their money is created and managed. Furthermore, Bitcoin’s decentralized nature provides a safeguard against inflationary monetary policies and currency devaluations. Since there is no central authority controlling Bitcoin’s supply or value, individuals can trust that their wealth will not be eroded by arbitrary decisions made by those in power.

In conclusion, Bitcoin represents a seismic shift in the way we think about money creation. By putting the power to create money in the hands of individuals rather than centralized authorities, Bitcoin offers an unprecedented level of freedom and autonomy. As more people become aware of this revolutionary technology and its potential to transform the global economy, we can expect significant changes in how societies interact with money. Ultimately, Bitcoin embodies a new era where financial sovereignty rests with individuals rather than institutions. As Bitcoin continues to evolve and mature, it will be exciting to see how it reshapes our understanding of what it means for people – not just governments or banks “to create money”.