Money And Power Are Inseparable

The relationship between money and power is a complex and multifaceted one. Throughout history, the control of money has been a key factor in determining the distribution of power and wealth in society. Those who have controlled the production and distribution of money have often held significant power and influence over the economy and politics. However, with the advent of Bitcoin, this dynamic is changing. For the first time in history, individuals have the ability to take control of their own financial lives and participate in a monetary system that is not controlled by central banks or governments.

The Stone Age Of Money

The stone age of money was a primitive yet fascinating era in the evolution of currency, marked by the use of various precious minerals and commodities as mediums of exchange. One of the earliest forms of money was electrum, a naturally occurring alloy of gold and silver, which was used by the ancient Lydians in modern-day Turkey around 700 BC.

Other precious minerals like copper, bronze, and iron were also used as forms of currency, often in the form of ingots, rings, or other decorative items. Additionally, shells, beads, and other commodities were used as money in various cultures, highlighting the resourcefulness and creativity of our ancestors in creating systems of exchange. Some cultures even used large stones that were transported from miles away by boat and ownership was a public record that only changed ownership when the entire community all knew and agreed on it (kind of like bitcoin’s consensus rules).

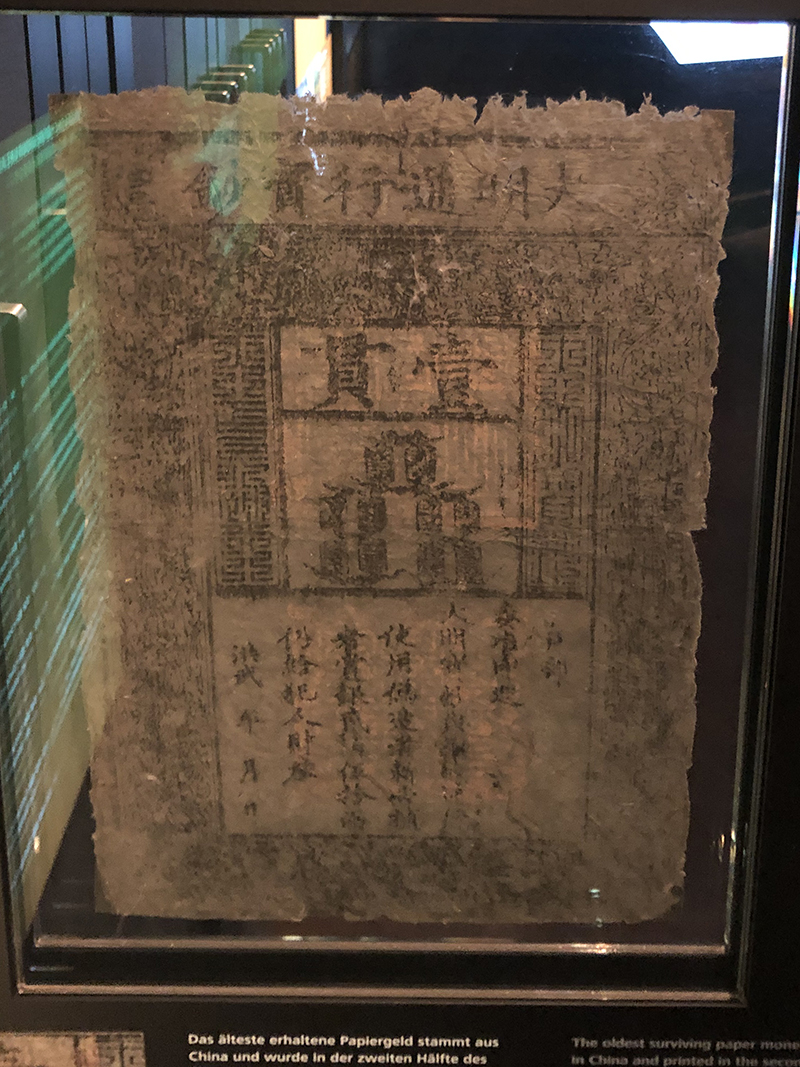

Source: Museum Of Money – Frankfurt, Germany

As civilizations developed and trade expanded, the use of precious minerals and commodities as money laid the foundation for the development of more sophisticated monetary systems, ultimately paving the way for the emergence of coins, paper currency, and eventually, digital forms of money. Despite its primitive nature, the stone age of money demonstrates the innate human desire for trade, commerce, and financial innovation.

The Golden Age Of Money

In the past, money was often backed by precious metals such as gold and silver. This was known as the “Golden Age” of money, where the value of money was the physical trade value of a physical commodity. During this time, money was scarce and its value was determined by the rarity and difficulty of extracting the precious metal. This system had its limitations, as the supply of money was limited by the amount of gold and silver that could be mined which often led to other forms of money being required as a supplement (like Wampum in the early American Colonies). However, it also provided a level of stability and predictability, as the value of money was tied to a physical asset and money could not be printed out of nothing.

The use of precious metals as money also had a profound impact on the distribution of power in society. Those who controlled the mines and the production of precious metals held significant power and influence. However, the scarcity of money also limited the ability of governments and central banks to manipulate the economy through monetary policy. This meant that the economy was more subject to the forces of supply and demand, rather than the whims of policymakers.

The Representative Age Of Money

As societies grew and trade increased, the need for a more efficient and convenient form of money arose. This led to the development of paper money, which was initially backed by precious metals or other commoddities held in vaults. This was known as the “representative” age of money, where the paper money represented a claim on a physical asset held in a vault. During this time, the value of money was still tied to the value of the precious metal, but the convenience of paper money made it easier to conduct trade and commerce.

However, over time, the link between paper money and precious metals was broken, and the value of money became more subjective. This marked the beginning of the end of the representative age of money, as governments and central banks began to manipulate the supply of money to achieve their policy goals. The ability to print money and control the supply of credit gave governments and central banks significant power and influence over the economy.

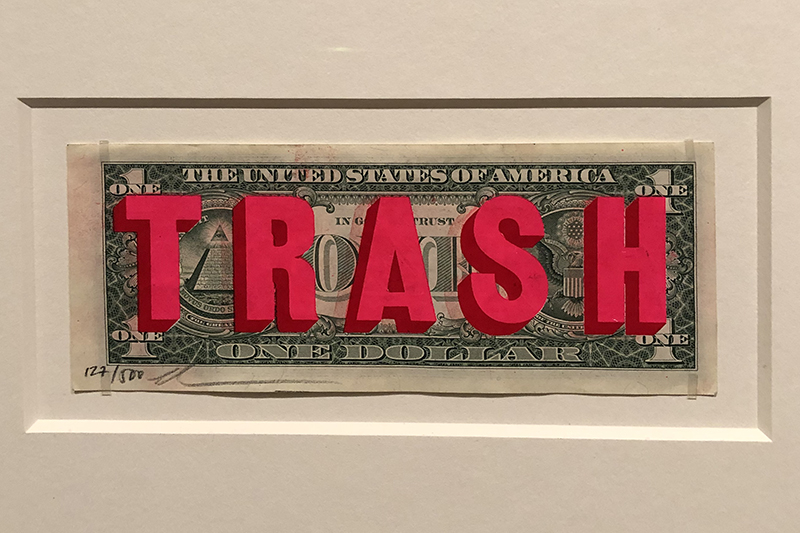

The Fiat Age Of Money

Today, we live in the “fiat” age of money, where the value of money is determined by government decree rather than any physical asset. The word “fiat” comes from the Latin phrase “let it be”. In the context of money, it means that the value of money is created by government decree, rather than any inherent market value. This system has given governments and central banks significant power to manipulate the economy through monetary policy.

However, the fiat age of money has also led to a number of problems, including inflation, currency devaluation, and a widening wealth gap. The ability to print money and control the supply of credit has allowed governments and central banks to fund their activities without being subject to the same discipline as the private sector. This has led to a significant increase in the money supply, which has driven up prices and reduced the purchasing power of consumers.

The fiat age of money has also led to a devaluation of labor, as the increasing money supply and inflation have reduced the value of wages and savings. This has made it more difficult for individuals to achieve financial stability and security, as the value of their money is constantly being eroded by inflation. The fiat age of money has also led to a significant increase in income and wealth inequality, as those who have access to credit and capital have been able to accumulate wealth at a faster rate than those who do not.

Bitcoin And Power Are Inseparable

Bitcoin is a new form of money that is decentralized, digital, and scarce. It is not controlled by any government or central bank, and its supply is limited to 21 million units. This makes it the hardest money in history, as its value is not subject to the same manipulation as fiat currencies. When you use Bitcoin, you take the power of money production back from the central banks who have the power to print money out of nothing.

Bitcoin is also a more democratic form of money, as it allows individuals to participate in the monetary system without the need for intermediaries. This reduces the power of central banks and governments to control the economy through monetary policy. Bitcoin also provides a level of transparency and accountability that is not available with traditional fiat currencies. All transactions are recorded on a public ledger, which makes it possible to track the flow of money and prevent fraud and corruption.

The use of Bitcoin also has the potential to reduce income and wealth inequality, as it provides access to financial services and opportunities for economic mobility. Bitcoin is not subject to the same borders and restrictions as traditional fiat currencies, which makes it possible for individuals to participate in the global economy regardless of their location or circumstances. This has the potential to create a more level playing field, where individuals have equal access to financial services and opportunities.

Take Action. Use Bitcoin.

All throughout history, it’s clear that money and power are inseparable. For as long as money has been used, the control of money has been a key factor in determining the distribution of power and wealth in society. However, with the advent of Bitcoin, individuals have the ability to take control of their own financial lives and participate in a monetary system that is not controlled by central banks, governments, or corporations.

Using Bitcoin is a way to take action and participate in a more democratic and decentralized monetary system. It provides a level of freedom and autonomy that is not available with traditional fiat currencies, and it has the potential to reduce income and wealth inequality. Bitcoin is not just a new form of money, it is a new relationship between money and power. It is a way to challenge the status quo and create a more just and equitable society.

So, take action and use Bitcoin as the means to restore the balance of money and power in your own life.

1 thought on “Money And Power Are Inseparable”

Comments are closed.

[…] This creates a system where politicians are essentially bought and paid for. They become puppets on strings, with their donors pulling the marionette’s handles. The people who elect them are nothing more than an afterthought, a necessary evil to get to the real goal: money and power. […]