Historically speaking, money has almost always been issued by those who rule but Bitcoin is slowly changing that. Rather than money being issued by centralized entities such as banks or governments, money is now able to be produced by decentralized systems like Bitcoin. This might not seem like such an amazing invention but as time goes on, we will see more of the economic benefits for the network of users who choose to use bitcoin.

Where Does Money Come From?

Contrary to popular belief, money is not an invention of government. It began as a social construct for societies that needed to be able to exchange value amongst themselves. It didn’t take long for governments to realize that if they have control over the money supply that they could print money and use it to benefit themselves rather than the people that they are supposed to be serving.

The problem with this centralized model is that it gives the issuer of money the power to devalue the currency that is already in circulation. As history has shown us, this sort of centralized money supply has been abused time and time again. We’ve seen it abused most recently in Venezuela and back in 2008 in Zimbabwe when hyperinflation destroyed the value of the Zimbabwean dollar with inflation rates greater than 89,000,000,000,000,000,000,000.00%. Yes, you read that correctly. That’s annual inflation greater than 89 sextillion percent! To put that into perspective, most first-world countries have annual inflation rates of less than 10%.

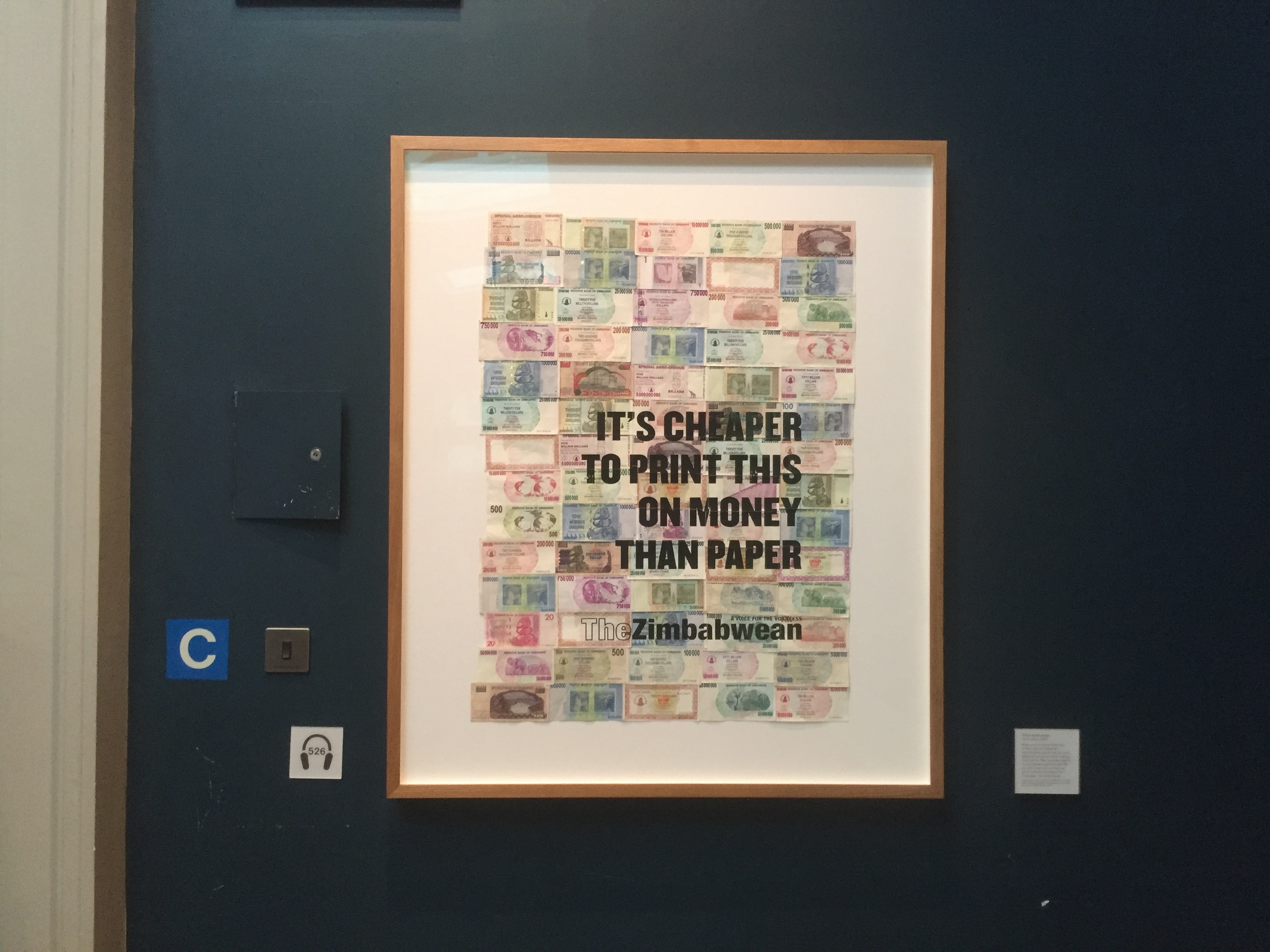

This poster (which is currently on display at The British Museum) made out of devalued Zimbabwean dollars shows just how dangerous it is to have a centrally controlled monetary system.

Bitcoin Is Money Issued By Math

Rather than some sort of centralized model of issuing money, the supply of Bitcoin is controlled by math. There is no centralized party that is in control of the supply of Bitcoin so it puts more economic power back into the hands of those who hodl it. It’s mathematically impossible to have runaway inflation with Bitcoin since the supply of new bitcoins is based on how much computational hashing power (Bitcoin mining power) and electricity that miners have at their disposal. There is currently no government on the planet that has the ability to create more bitcoin than the protocol will allow. Every time 2,016 blocks are mined, the difficulty of the hash rate adjusts to limit the production of new bitcoin.

In short, there is currently no way to inflate the supply of Bitcoin so that one single entity could have control of the supply of new bitcoin.

Use Bitcoin

Like the title of this post highlights, for almost all of history, money has been issued by those who rule but bitcoin has the potential to change that by creating a system that is based on open-source math that is completely transparent. If you’re interested in taking control of your own money while also supporting a system that puts the power of money in the hands of the people, I’d like to encourage you to use Bitcoin.